Automated System for High-Risk Client Monitoring and Regulatory Compliance

Risk Monitoring and Classification System: Enhancing Compliance and Security Through Detailed Client Profiling

The project was implemented for two financial institutions in Romania operating in the banking sector. Faced with rising regulatory demands and operational risks related to client onboarding and monitoring, the banks needed a solution to improve how high-risk clients were recorded, classified, and managed in compliance with KYC and AML regulations.

Initial Challenges

Before implementation, the banks lacked an integrated system for capturing and managing high-risk client data. KYC and AML teams were forced to rely on manual procedures and fragmented tools to identify clients with suspicious activity, criminal records, or media exposure. The absence of automation, centralization, and cross-departmental visibility led to operational inefficiencies, delayed actions, and exposure to regulatory penalties.

The impact extended across several departments. KYC and AML staff spent excessive time collecting and updating information manually, which increased the risk of errors. Compliance and audit teams faced challenges in preparing for inspections, while executive leadership had limited access to reliable insights needed for risk oversight. In some cases, delays in identifying high-risk clients affected the institution's ability to act quickly and prevent potential fraud or violations.

The Smart Solution

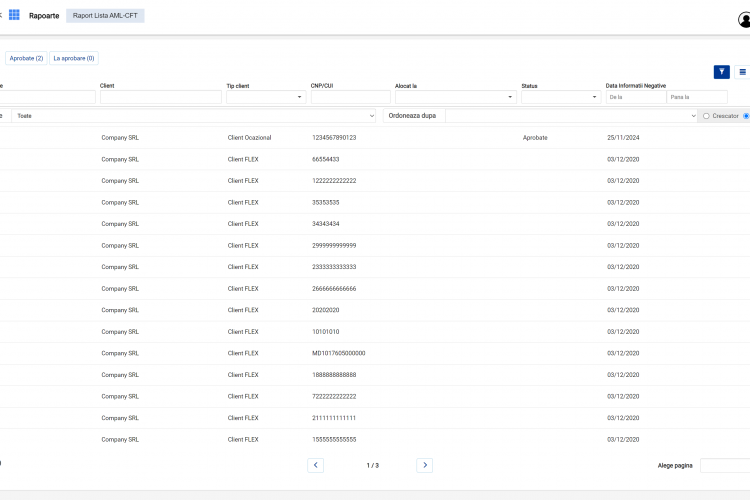

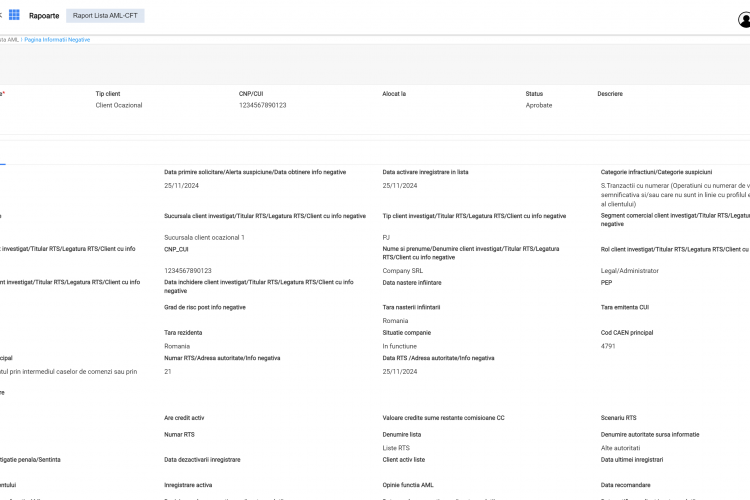

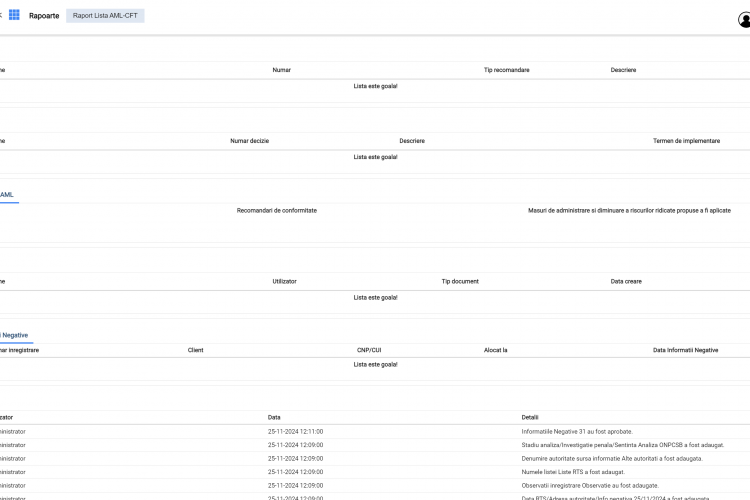

To address these challenges, a specialized application was developed to track, manage, and classify high-risk client data not captured by the core banking system. The system enabled KYC and AML departments to log clients flagged for suspicious behavior, legal investigations, or reputational risks. Key features included a searchable interface for adding and updating profiles, a consistent historical log, automated export of risk data to Word and Excel formats, and centralized document management. The solution ensured up-to-date records, efficient collaboration, and compliance with legal and regulatory obligations.

Implementation Insights

During implementation, the team encountered several technical and operational challenges. Integrating the application with existing platforms such as Flex Cube and AML-CFT required adjustments to ensure smooth data flow. Maintaining data consistency across systems was another major priority, addressed through centralized databases and automated syncing. User adoption was encouraged through targeted training and a user-friendly interface. Document management posed initial challenges due to file size limitations, which were solved by optimizing the upload module. Through cross-functional coordination and responsive iteration, the system was successfully embedded into daily operations.

Results & Impact

The new risk tracking and classification system generated significant improvements across compliance operations and client monitoring:

Quantitative Results:

- Reduction in data entry errors due to automation and centralized records

- Faster processing and classification of high-risk clients compared to previous manual workflows

- Increase in the number of tracked clients, improving monitoring accuracy

- Full compliance during audits with zero penalties or fines reported post-implementation

Qualitative Results:

- Higher user satisfaction driven by intuitive design and smoother workflows

- Improved collaboration between AML and KYC departments with shared access to records

- Greater operational flexibility and speed in identifying and managing client risk

- Enhanced regulatory readiness through accurate, real-time client risk profiles

These results allowed the institutions to move from reactive, manual monitoring toward a proactive, data-driven compliance posture.

Lessons Learned & Key Takeaways

This project demonstrated the importance of defining clear functional requirements and maintaining close coordination between technical and regulatory teams. Data consistency and real-time syncing between systems were critical to achieving accuracy and audit readiness. Early engagement with end users and iterative training ensured strong adoption. Scalability was built in to accommodate evolving regulations and an expanding client base. Ultimately, automating high-risk client tracking improved compliance, reduced manual workload, and strengthened the organization’s risk posture.